What does the Church need money for?

Taunton Baptist Church is a member of the Baptist Union of Great Britain. But we receive no funding from this or any other body. Instead, the costs of the Church’s ministry (including all paid workers and the running of the building) are met by donations from the members and the congregation alone.

Each year in the autumn, the Church agrees a budget for the following year which sets out the cost of the plans for the forthcoming year and the amount of giving that is required to finance it.

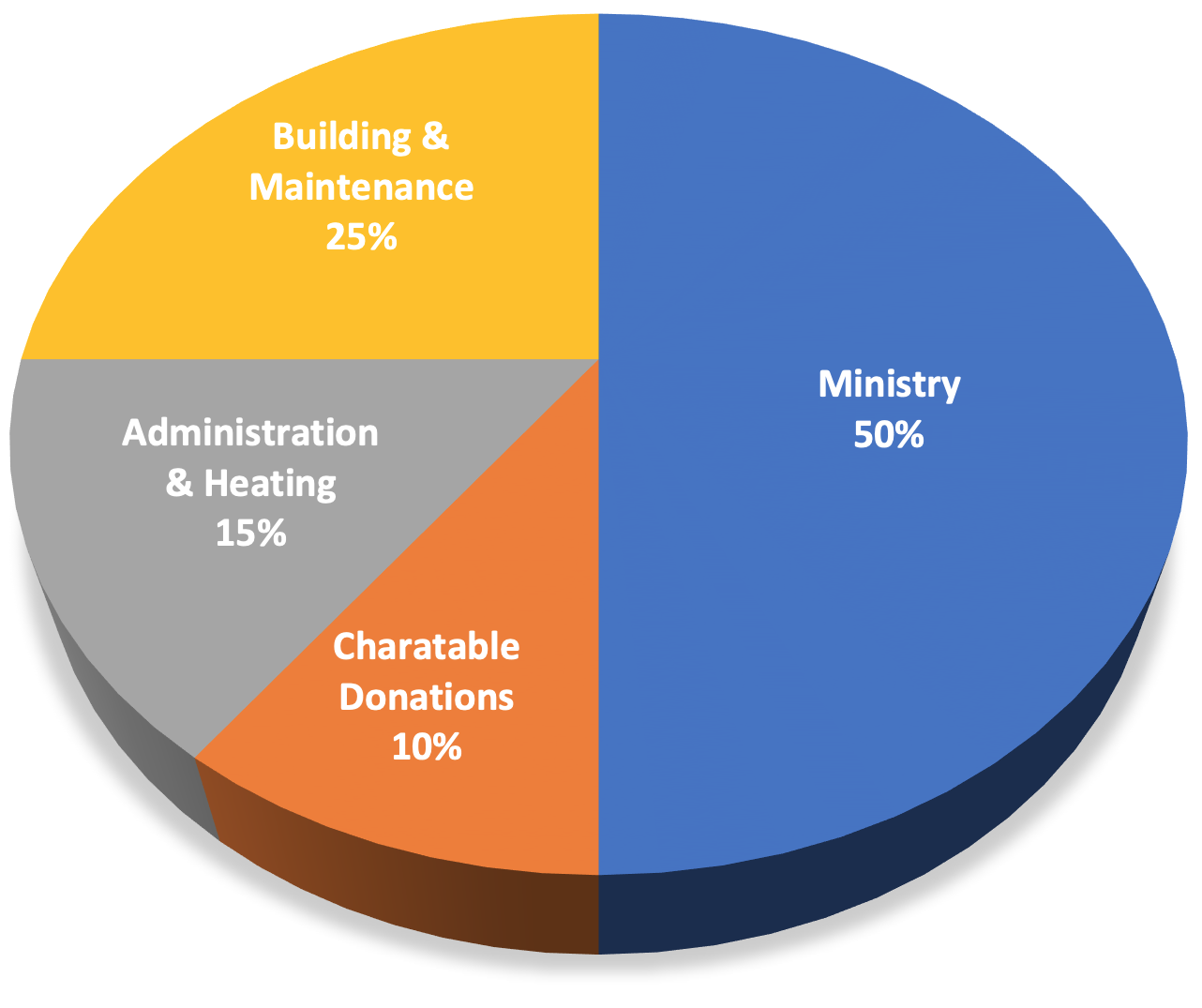

The following chart illustrates the typical areas where the Church spends its money:

The Church is committed to supporting a number of other causes through its budget – in particular BU Home Mission and BMS World Mission. These gifts mean we can participate in the Lord’s work in small Baptist churches across the country, as well as helping to make Jesus known through missionaries and partner agencies overseas.

How much should members give?

The way that we give to our Lord’s work is even more important than how much we give. The Bible encourages us to give regularly, sacrificially but cheerfully; to make our gift a response of worship to a God who is responsible for what we have and are. It is for each individual to decide for themselves, before God, how much they should give, but we would suggest that the Old Testament “tithe” (or 10% of income) is worth considering as a general guide.

As a rough guide, the level of giving required to finance this ongoing spending equates to about £100 per member per month. Although the regular congregation should feel encouraged to contribute to our costs, we underline to our Church Members particularly their responsibility in this area.

How can I support the Church financially?

On site

- Cash or cheque – in an offering box (inside the back door of the Sanctuary)

- Credit or debit card – a card reader is in the foyer, where you can make a one-off gift

Alternatively

- Bank transfers – either by a one-off gift or a regular Standing Order can be made direct from your bank account to the Church’s account (Sort Code: 40-52-40, Account No: 00021894)

- National giving schemes (such as Charities Aid Foundation or Stewardship) – whereby you can give to several charities at once and your donations are passed on periodically to the Church. These schemes collect any Gift Aid that is applicable

What about Gift Aid?

Gift Aid is a government scheme that allows charities to reclaim the standard rate that has been paid on your gift. It means that for each £1 you give, the church is able to claim back from the government an additional 25 pence in the £. You just need to sign a Gift Aid form and the scheme continues in place for as long you pay income or capital gains tax at least equivalent to the amount of tax being reclaimed by the Church.

How can I find out more?

Please contact our Treasurer, William Venn, who will be happy to advise and supply the relevant forms. Alternatively, select the buttons below to download the form(s) you require.